|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Take Out a Mortgage: Expert Tips and Advice for HomebuyersUnderstanding MortgagesWhen you decide to take out a mortgage, you're committing to a significant financial decision. Mortgages are loans specifically used to buy real estate, where the property itself acts as collateral. Types of Mortgages

Important Terms to KnowFamiliarize yourself with terms like principal, interest rate, and amortization schedule to better understand your mortgage agreement. Qualifying for a MortgageBefore applying, ensure you meet the necessary requirements, such as having a stable income and a good credit score. Down PaymentThe down payment is a crucial factor. Most lenders require at least 20% of the home's purchase price. However, programs like the low income house buying program may offer alternatives for eligible buyers. Credit ScoreYour credit score plays a significant role in determining your eligibility and the interest rate you will receive. Aim for a score above 700 for favorable terms. Managing Your MortgageOnce you've secured a mortgage, managing it wisely is key to maintaining your financial health. Budgeting

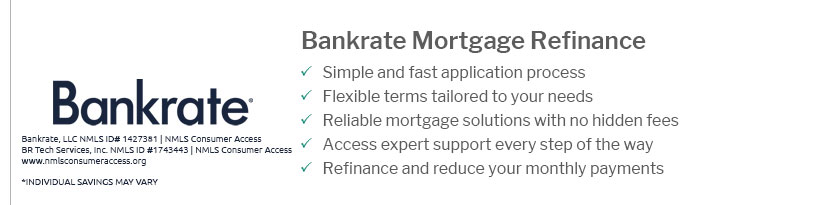

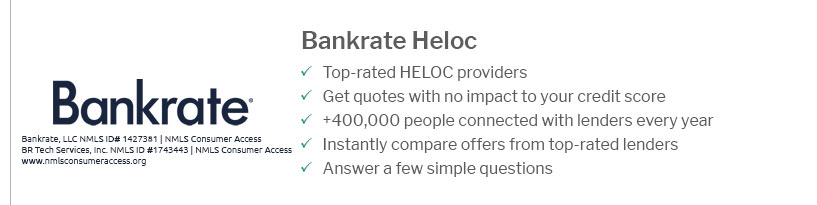

Refinancing OptionsConsider refinancing your mortgage if interest rates drop. This can reduce your monthly payments and overall interest costs. Check the conventional loan limits to see if refinancing is a viable option for you. FAQsWhat is the difference between pre-qualification and pre-approval?Pre-qualification is an estimate of what you might be able to borrow, while pre-approval is a conditional commitment from a lender based on a detailed evaluation of your financial situation. How does an adjustable-rate mortgage work?An adjustable-rate mortgage typically starts with a lower interest rate that adjusts after an initial fixed period. The rate can increase or decrease based on market conditions, affecting your monthly payments. Can I pay off my mortgage early?Yes, most lenders allow early repayment, but it's essential to check for any prepayment penalties that might apply. Paying off your mortgage early can save significant interest over the life of the loan. https://www.consumerfinance.gov/ask-cfpb/what-costs-come-with-taking-out-a-mortgage-en-153/

You pay for mortgage and homeownership fees either up-front when you first take out the mortgage, or over time by paying them with your monthly mortgage ... https://www.nerdwallet.com/article/mortgages/how-to-get-a-mortgage

1. Give yourself a financial checkup. Before you set off to get a mortgage, make sure you're financially prepared for homeownership. https://www.bankrate.com/mortgages/how-to-get-a-mortgage/

This guide breaks down the mortgage process so you'll know what to expect when you apply for a home loan.

|

|---|